The latest Quarterly Economic Survey (QES) conducted by Greater Manchester Chamber of Commerce shows businesses are much more positive than they were in the first quarter of the year.

While the previous survey for Q1 2024 showed a sharp decline in economic performance, this survey paints a more optimistic picture with increased sales and growth in both business and consumer confidence.

The QES results were released at the Chamber's Q2 Economic Review, sponsored by Intercity and Centrality who provide comments below.

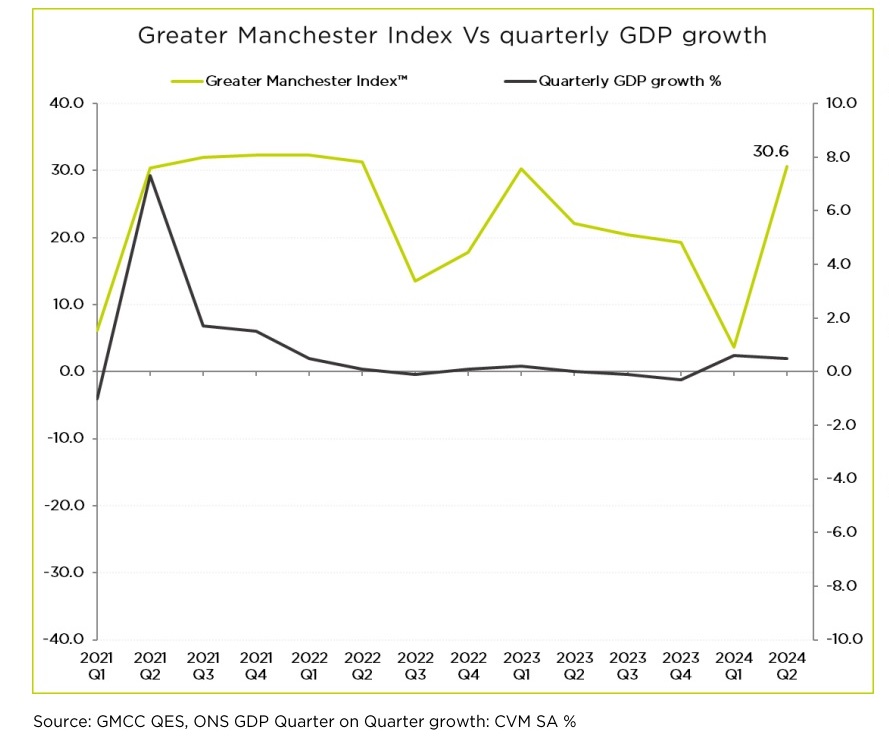

While the previous survey for Q1 2024 showed a sharp decline in economic performance, this survey paints a more optimistic picture with increased sales and growth in both business and consumer confidence. The Greater Manchester Index™, a composite indicator made up of key QES measures is now at 30.6, which is a 27-point increase from the previous quarter.

Subrahmaniam Krishnan-Harihara, Deputy Director of Research at Greater Manchester Chamber of Commerce, said: “The first quarter of this year was not a great quarter. In fact, it was the worst for quite some time. This quarter, however, shows consumer confidence is returning and a lot of growth took place since March. We’ve seen a growth in services, and manufacturing and construction are at their highest levels for months.”

Although headline CPI has now come down and is at the 2% target, businesses are still concerned about inflation. In fact, businesses reported that inflation was their main concern although the proportion of businesses worried about inflation has gone down relative to 2023. Wage inflation remains a particular concern.

The survey shows domestic demand and overseas demand have both risen, although the sub-regional breakdown reveals growth in the North of Greater Manchester, while the city centre has seen a marginal decline and international activity has gone down in the South. Overall, quarterly domestic sales balance increased from -4.7 in Q1 to +18.0 and quarterly sales from -5.2 to +11.1.

Explaining these differences, Subrahmaniam said: “The reason for this is the sectoral make-up of the different parts of Greater Manchester. There is more manufacturing in the North and there has been a significant increase in manufacturing. Hospitality and retail have been doing less well and they are concentrated in the city centre and the South of Greater Manchester is more focused on logistics and is home to the airport.”

He added: “Sixty-seven per cent of the UK economy is based on consumption, so we are heavily reliant on consumer spending. Retail sales saw a turnaround in May and there is more confidence than we have had for some time. People are more willing to spend even though the prices for retail goods are still going up. There have been pay rises with big increases in the Living wage and Minimum wage, disposable incomes have gone up and cost of living pressures have eased. We can afford these increases if we are prepared to pay more for goods and services. Confidence is up and recruitment activity has gone up. There are good numbers on recruitment with many employers expecting to increase their workforce.”

The UK is one of the largest exporters of services in the world. While export sales for services and manufacturing have both gone up, there remain concerns about the UK’s trading relationship with the EU.

“We export more to the EU than the rest of the world – 46% of our exports go to the EU and nearly 60% of our imports come from the EU too,” Subrahmaniam said, “Trade with the EU has to be a priority of the new government. Recent Free Trade Agreements don’t add a lot as the trade with many of these countries is so small. Yet trade with EU was barely mentioned during the election campaign.

“On domestic policy, all the major parties said during the campaign said that they didn’t want to cut services or raise taxes, yet these are mutually exclusive. Will a new government invest in infrastructure in the North West? Will businesses invest? These are the issues on which businesses will expect clarity and perhaps, a different direction of travel.”

If you missed Q2 Economic Review, you can watch a video of it here and download the slides from the presentation here.

James Finucane, Head of Channel and Sales Specialist at Intercity, said: "I was delighted to speak on 'The Impact of AI in Business Growth' at the GMCC's Economic Review last week. This event provided a fantastic platform to share key trends and insights with industry peers, engage directly with attendees, address their questions, and dispel common misconceptions. It also underscored the critical need for businesses to advance their cybersecurity measures in response to rising threats.

James Finucane, Head of Channel and Sales Specialist at Intercity, said: "I was delighted to speak on 'The Impact of AI in Business Growth' at the GMCC's Economic Review last week. This event provided a fantastic platform to share key trends and insights with industry peers, engage directly with attendees, address their questions, and dispel common misconceptions. It also underscored the critical need for businesses to advance their cybersecurity measures in response to rising threats.

"I strongly encourage all businesses to take advantage of our complimentary Copilot Readiness Workshop. It’s an excellent opportunity to gain peace of mind and boost productivity, with nothing to lose.’’

Intercity is offering Chamber members the opportunity to book a FREE Microsoft workshop from its range - book your place here.

Simon Mullins, Sales & Marketing Director at Centrality, added: "93% of businesses are currently using AI or plan to within the next year, and it's only going to continue to grow.

Simon Mullins, Sales & Marketing Director at Centrality, added: "93% of businesses are currently using AI or plan to within the next year, and it's only going to continue to grow.

"Businesses need to be a step ahead when integrating AI tools into their environment to ensure that their data remains protected, not just from hackers but insider risk too. That's where we come in."