Export documentation refers to the various forms and paperwork required when a company or individual exports goods or services to another country. Proper documentation is essential to ensure smooth customs clearance, comply with trade regulations and facilitate international trade transactions.

Some of the most common export documents are Certificate of Origin, EUR1, Commercial Invoice, Packing List, Bill of Lading, Export Licence etc. Here we will review EUR1 and the most common mistakes that occur when applying for this document.

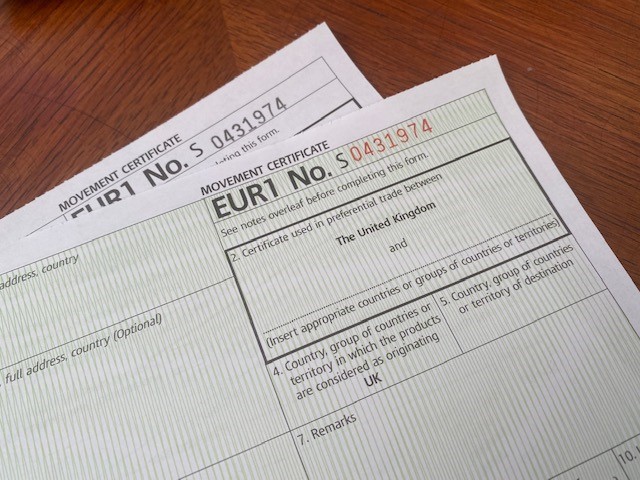

The EUR1 certificate (also known as a "Movement Certificate") is utilised for goods being exported from one country to another when the exporter wishes to claim preferential tariff treatment under a trade agreement between the exporting country and the importing country. The primary purpose of the EUR1 certificate is to prove the origin of the goods and thereby qualify for reduced or zero customs duties.

Here we have gathered a list of the most common mistakes that exporters/freight forwards make when applying for an EUR1:

Box 1: Exporter

It must be a UK company and a full UK address. Should have “United Kingdom” following the address (“UK” will not be accepted).

If you are applying on behalf of a company outside of the UK, you need to add first UK Company name, full address of UK company, add United Kingdom and then “on behalf of” and the Foreign Company Name, but you cannot mention their address or country name. A Letter of Authority must be presented with the application.

Box 3: Consignee

Full name of the country – no abbreviations, only UAE or USA are accepted. “EC Community” or a region (ie. South East Asia / Middle East) will not be accepted. Can be left blank should the consignee not be known.

For both Exporter and Consignee, make sure that the address entered fully matches the address on the supporting evidence provided (commercial invoice, P/L etc). If you have two different addresses on the supporting evidence, like “Bill to” and “Ship to” / ”Delivery”, always enter the “Ship to” address rather than the “Bill to” address.

Box 5: Country of Destination

Put the name of the individual country of destination and avoid “GSP Beneficiary Country”.

Box 6: Transport details

Only the mode of transport should be entered: “sea freight”, “road freight”, “air freight”.

This field is optional as the transport details might change throughout the process, so if you enter the transport details as truck number or container for example, make sure that they are also shown on your supporting evidence documents and matching, because if this information changes at the last minute, the certificate will not be valid anymore and you will need to reapply.

Box 7: Remarks

Can only be used when retrospective/duplicate or replacement certificates are issued. If retrospective, you must provide transport documents with your application.

Box 8: Description of goods

In this box, attention should be given to the Shipping marks. You must enter the actual marks and numbers on the packages being shipped (e.g. lead marks, port marks, actual numbers, etc.). If the package is addressed the words “fully addressed” can be entered. If unmarked, “unmarked” should be entered.

If you add marks on that box, make sure to also show these marks on your supporting evidence.

Also, when adding the description of goods, you cannot use “STC” (Said to Contain) or negative statements.

Box 12: Declaration by the exporter

This box must be signed by the Exporter. Can be signed by an agent as long as there is a letter of authority (LOA) . If a pre-signed EUR1 is required, you will need to send blank pre-signed form to our office or collect and sign the EUR1 on collection.

Reverse of the EUR1:

The goods shown on the movement certificate were manufactured/produced by the exporter and are classified under (4 figure tariff heading). They satisfy the appropriate qualifying process in the preferential agreement.

The goods shown on the movement certificate were manufactured/produced in the UK and are classified under (4 figure tariff heading). Evidence of their originating status in one of the forms specified on gov.uk is held by us.

Make sure to enter the correct Tariff codes and that they are the ones that your supporting evidence shows.

When submitting on behalf of, make sure that the declaration on the LOA actually matches the statement on the reverse (were manufactured/produced by the exporter or were manufactured/produced in the UK).

Also make sure that the invoice number added to the LOA matches the actual invoice number of the invoice provided.

Additional information:

- Proforma invoices are not accepted.

- Not adding marks is not accepted.

- If you add cube weight, make sure that it is also shown on your supporting documentation.

If any of the above are not correct or matching, we will require additional information or will have to reject the application for amendments to be made. Avoiding these mistakes saves a lot of time and also saves you from getting your documents rejected and/or delayed.

If you need help in completing your EUR1s, do not hesitate to contact us as per the below information.

Please make sure to check our upcoming UK CERTIFICATES OF ORIGIN AND UK EUR1S STEP-BY-STEP WORKSHOP - SEPTEMBER 2023 which is designed for beginners or experienced exporters looking to refresh their knowledge.

For more details or to book your place, click here. If you would like further information on future dates, please contact us as per the above details.

Need further advice on EUR1s COO, documentation, customs clearance or other?

If you have any questions about the above or would like support in your international trade journey, please email exportbritain@gmchamber.co.uk or call 0161 393 4314.