Chamber Partner Enexus looks at whether businesses will be affected by the Domestic Price cap increasing in October.

You may have seen in the news that the domestic price cap is increasing this October. This is the first major increase in price cap since recovering from the peaks of the energy crisis over the Winter of 21/22.

The first thing to know is that there is no price cap for businesses. The second thing to know is that the price cap, and domestic prices in general, take their cues from market movements 4-6 months ago. Business prices on the other hand, are much more current and move daily in line with the prevailing conditions. So anything that happens in the domestic market is 'old news' in the business energy world!

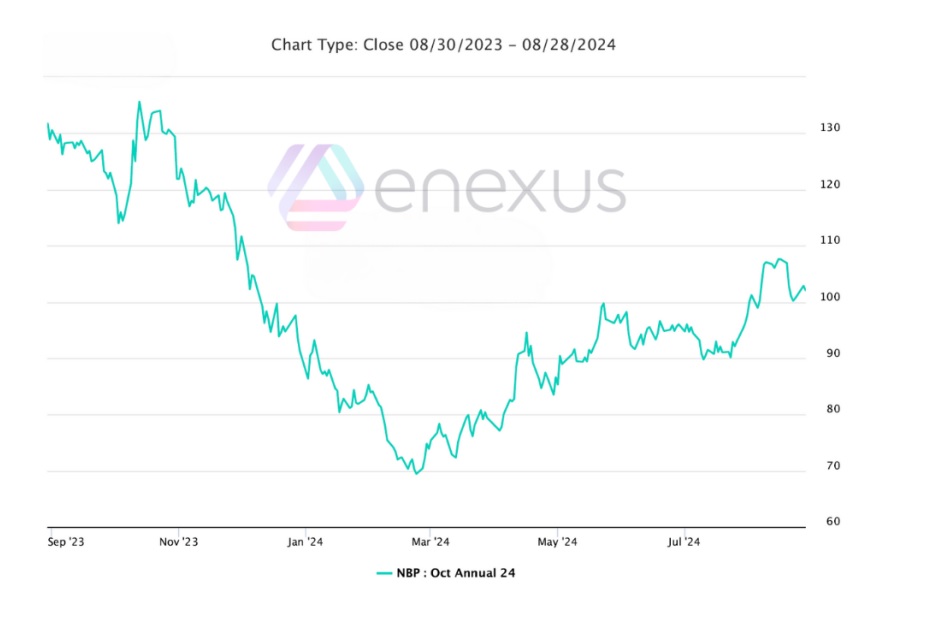

With that in mind, let's take a look at the energy market:

Prices hit a floor late February as the market reacted to another very mild UK winter and the resulting lower heating demand across the country. Post February we saw a steady increasing pattern throughout Q2. It is this period of rises that has resulted in the increase in price cap for domestic users that will be applied in October.

However, prices have increased further in recent weeks, largely due to increasing tensions in the Middle East and energy assets being directly affected in the Ukrainian conflict. Businesses are already dealing with these further increases as any business looking at a new contract will see these increases reflected in their offers.

So what is the best course of action?

Well, for domestic users, unless something significantly changes in the next month or so, it is likely that the cap will again rise in January to reflect the increases we have seen in the last few weeks. So fixing a rate before October, will likely be the best solution.

For businesses, we can never be as certain which way the market will move. The key drivers right now are the tensions in the Middle East, the Ukrainian conflict and the prospect of cold weather this winter.

The weather is uncertain of course. Another mild winter could see prices fall around the turn of the year. But, in that time, if we see an major escalation of violence in the Middle East, or significant damage to an energy asset in either Ukraine or Russia and we could see prices move very quickly. Our advice to any business with a fixed contract due to end in the next 12 months, would be consider eliminating these risks, by securing today's rates to start when your current contract ends.